90’s market disruptors, Netflix and Hulu, edged out by the next generation of online streaming services

Credit: Elias Nagel-Bennett

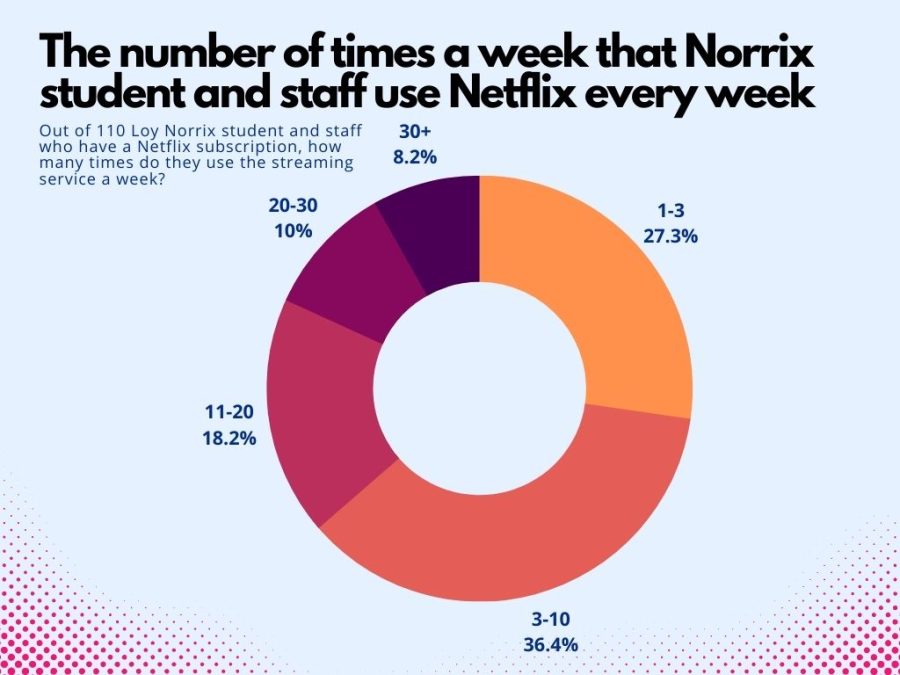

While Netflix may be losing stock price, it is still the most popular and most regularly used streaming service among Norrix students and staff.

May 31, 2022

From novels, to the radio, to TV and cable, and now online streaming, the consumption of entertainment has evolved almost every generation since the start of the 20th century. Nowadays, fans of a show don’t have to check a TV guide to find the times of their favorite series in order to catch it on air – they can access any and all at the tap of a remote.

According to a Statista survey by Julia Stoll, 78% of Americans are subscribed to at least one streaming service, this number only growing every year.

There are a number of big names in the streaming world, most of which are older than their primary consumers: the under-18 market. The most notable, Netflix, was founded in 1997, initially serving as a mail-based rental service, using a similar structure to Redbox, where individual movies could be rented or sold.

Hulu, one of Netflix’s main competitors, was unveiled in 2006, while another giant, Amazon Prime Video, came about later the same year.

Other services, like HBO Max and Disney+ are more recent but follow the same formula: a monthly paid subscription to a large swath of content, with original shows or movies serving to attract new customers. The price of standard subscriptions on these services often hover around $15 per month, with more premium options costing quite a bit more, an average of $25 dollars.

However, in the past five years, a multitude of newer, and often alternative streaming services have risen to prominence, especially during the lockdown when many people were able to consume everything they were interested in on services they were already subscribed to.

Tubi, for example, is a relatively new service established in 2014, and unlike other services, has no subscription cost, instead using ads to generate revenue. Tubi has seen a meteoric rise in membership, as according to The Streamable, the streaming service has doubled its size in the past two years.

Other new streaming services have seen similar success, offering content or experiences that the established streaming services don’t.

The much younger service, Peacock, not only holds a wide swath of third-party content, something Netflix has lost an edge on since the focus on their originals began in 2012, but also has live TV packages. Peacock has been able to recognize and adapt to the trend of the public who still watch events live. For example the Tokyo Olympics was largely watched live, as opposed to episodic TV shows or movies where modern audiences watch in a far more staggered manner.

Peacock, according to the Hollywood Reporter, has surged in popularity as of late, using the resources of an existing company to eclipse the more limited and expensive TV-streaming packages, such as the Hulu’s agreement with ESPN, which allowed the company to show football, baseball, and basketball games live on their platform, offering an alternative to broadcast TV, but with ESPN still being primarily watched on the more traditional broadcast, this move likely not enough for Hulu to be a real competitor in live TV.

Of course, the older and more traditional services still hold the clear advantage in number of subscribers and public recognition.

In a survey of over 100 Loy Norrix students and staff, Netflix’s dominance in pure subscriber numbers remains clear — with over 90% of respondents having a subscription to Netflix, leaps and bounds above the runner up, with only 70% of respondents subscribing to Disney Plus.

Netflix is also the streaming service which consumes the most time for the Loy Norrix community, as 72% go on Netflix at least 4 times a week, with almost 9% streaming via Netflix over 30 times a week. A plurality of respondents also stated original content as the most important feature for a streaming service, followed by streaming and then the ability to watch free content with the addition of ads. Netflix is the clear winner, especially amongst the younger demographic that largely populates Loy Norrix. However, almost all respondents who are subscribed to Netflix are also subscribed to at least one other streaming service, showing that many consumers have ready alternatives should they wish to move away from Netflix.

Netflixstill retains a dominant place in streaming, its name taking on a recognition similar to McDonalds or Walmart: it’s the streaming service, not just a streaming service. However, as of late, the once industry-shaping company has been stumbling.

“Personally I just bootleg movies,” said junior David Henry “because most of the things I like aren’t on streaming platforms, because of region-locked content.”

Even during 2020, as hundreds of millions in America alone were stuck at home and most streaming services saw a boom in subscribers and profit, Netflix saw little practical growth, their stock prices and subscriber count growing at the same rate as ever.

The other shoe would drop in 2021, as between November 17 and March 14, 2022, the Netflix stock price dropped from $691.69 to $331.01, a decrease of over 52% in a matter of months.

This comes not only amidst controversy over a crackdown on password sharing, but according to Chris Neiger from the Motley Fool, the streaming giant’s meteoric growth slowed down by 38% in the last financial quarter. Even as the streaming industry as a whole grew, Netflix lagged, spooking many investors, leading to a selling panic of Netflix stocks. Though there was a short-lived rally in price after this massive dip, in the weeks since, the price has been in a gradual slump.

It remains to be seen if the cycle of Blockbuster will repeat itself: the home video giant was only around for 25 years, and Netflix’s own 25th Anniversary was April 29th 2022, at which time the stock price again sank to an all time low of $190.36. Other announcements have come out of Netflix, many controversial. Whether massive slashes to their animation department, a possible inclusion of advertisements on their basic streaming package, or crackdowns on password sharing according to Jamie Lang from Cartoon Brew, all send the clear message that while Netflix is trying to recover value, this attempt to increase profitability may harm user experience and further curb the rate at which new subscribers join the service.