GUEST WRITER: PJ Singh

GUEST WRITER: PJ Singh

At some point in your life you’ll receive or give away large amount of money. For seniors planning for college after high school, that time may come sooner than later. There will be terms like gross pay, net pay, taxes, and deductions on that sheet of paper. You’ll have to know exactly what they mean before taking next steps on that amount.

Managing money is extremely difficult for teenagers and adults today. Whether it is a college student, who deals with loans, tuition cost, and personal expenses, or someone on the brink of retirement, with savings management, investments, or financial inheritance, people are faced with choices they aren’t very accustomed to, like choosing just the right kind of insurance.

The probability of a wrong financial decision increases if you are unaware of the consequences. So how can students in my age group, 14-18 year olds, prepare for their upcoming financial tasks? Thankfully, there is an elective course that Loy Norrix offers for all grade levels called Personal Financial Literacy. I believe this course should be required in KPS, considering the number of financial decisions we will make in our near future.

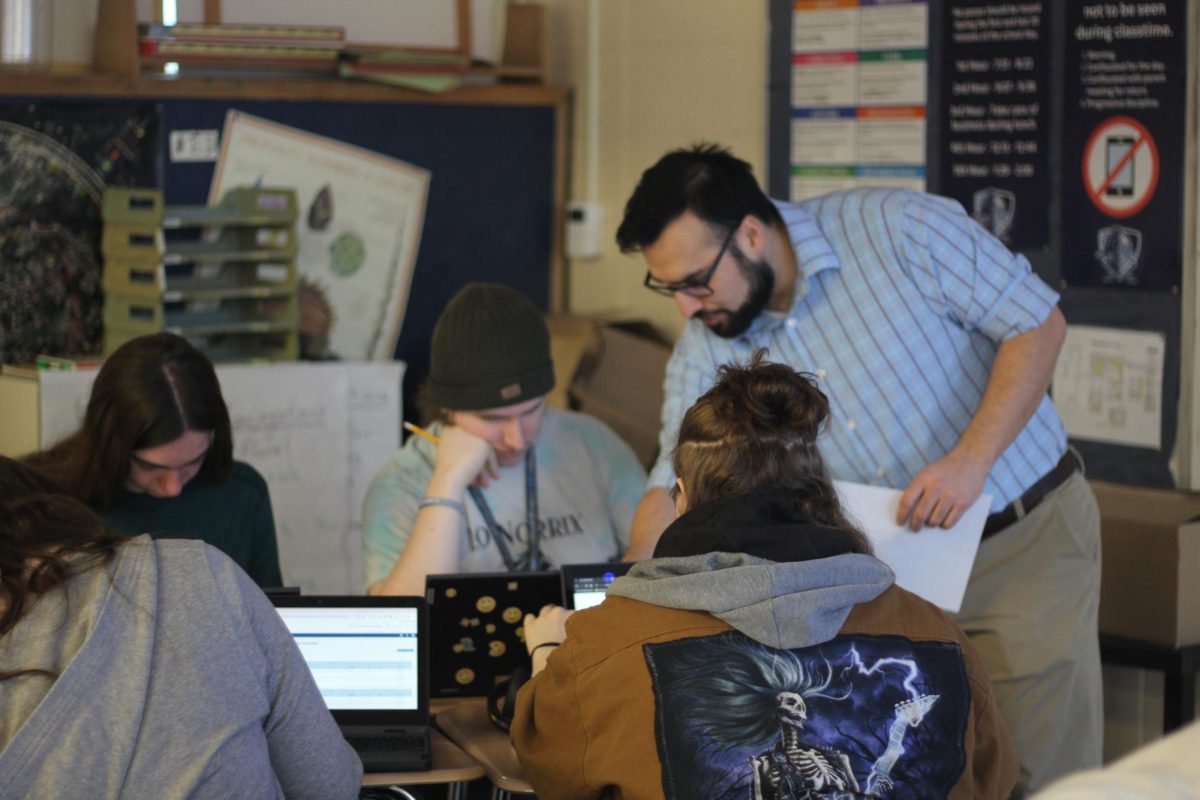

“Personal Finance is a class that introduces students to basic banking operations, credit cards and loans, cost/process of getting an education and finding a job, the purpose of taxes, and some basic economic factors,” said Samantha Maxwell, who currently teaches Personal Finance at Loy Norrix.

Personal Finance pushes students to apply their prior knowledge of mathematics in real life situations to help them make the best decision possible. You pick a career that interests you and begin with the cost of getting education. The cost will include tuition, loans, and personal expenses. The focus then shifts to solutions to pay for those costs through loans, scholarships, or borrowing with interest rates. Since the goal is to get students thinking about having financial stability, budgeting is introduced.

According to National Foundation for Credit Counseling, 56 percent of adults in the U.S do not have a budget.

“Many people go out on their own and don’t know enough about loans, balancing checking accounts, budgeting, and the proper way to deal with taxes. Then they struggle with money and put themselves in financial difficulty,” said Bradley Schmidt, who has also taught Personal Finance at Loy Norrix.

Budgeting is an important component in avoiding financial difficulties. It keeps your income and expenses updated to help you have stability. Long term payments like loans are also projected to give you awareness of the process. Loans are very common since 64 percent of students pay their college fees by borrowing money, according to Ohio State University.

Some students already have all this knowledge through their families. By the time they’re seniors, financing is basic information for them. These students would like to keep personal finance an elective course.

“Lot of students, especially if they’re seniors, have already experienced the things being taught and understand them, so a class about it can be a waste of time, especially when they could be learning about topics more related to the field of work they want to pursue,” said senior Lauren Hybels, who is currently taking personal finance.

Many students might prefer to take more rigorous course, like Statistics, to expand their knowledge. Financing may not be a challenge for them. Others may wish to take college level courses like Calculus, but it remains true that 32 percent of college students neglect their studies due to excessive debt. For students preparing for life in college, this is a scary fact. Though the Michigan Department of Education doesn’t require this course for graduation, KPS can make efforts to do so.

“The State Board of Education only makes Algebra 1, Geometry, and Algebra 2 mandatory in high school. Our school district can make personal finance mandatory but have chosen not to,” said Schmidt.

A change is a necessity here, and KPS can make that change by requiring Personal Finance for high school graduation.

Subscribe to the Newsletter

High number of underclassmen show promise after a successful season for the men's swim and dive team

The 2023-24 men's swim team is a great example of what teamwork and determination can create. Although more than half the team members were...

Lexi Tuley, Graphics Editor • April 24, 2024

It’s Monday morning. You’re sitting in your first hour on the brink of falling asleep. The teacher is droning on about geometry, and you...

Venelope Ortiz, Tower Talk Editor • April 19, 2024

The quiet corners of a teenager's room, where laughter once echoed freely, is now replaced by silent struggles that won't go away. A fight not...

Personal Finance for the Future

May 1, 2017

Leave a Comment

More to Discover